XAT 2011 Question Paper

Based on the following information.

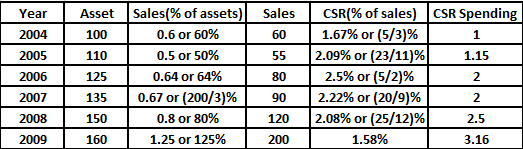

The following graphs give annual data of Assets, Sales (as percentage of Assets) and Spending on Corporate Social Responsibility (CSR) (as percentage of Sales), of a company for the period 2004 - 2009.

XAT 2011 - Question 61

The maximum value of spending on CSR activities in the period 2004-2009 is closest to which of the following options?

XAT 2011 - Question 62

In which year, did the spending on CSR (measured in Rs) decline, as compared to previous year?

Based on the following information.

Five years ago Maxam Glass Co. had estimated its staff requirements in the five levels in their organization as: Level - 1: 55; Level - 2: 65; Level - 3: 225 ; Level - 4: 255 & Level - 5: 300. Over the years the company had recruited people based on ad-hoc requirements, in the process also selecting ex-defence service men and ex -policemen. The following graph shows actual staff strength at various levels as on date.

XAT 2011 - Question 63

The level in which the Ex-Defence Servicemen are highest in percentage terms is:

XAT 2011 - Question 64

If the company decides to abolish all vacant posts at all levels, which level would incur the highest reduction in percentage terms ?

XAT 2011 - Question 65

Among all levels, which level has the lowest representation of Ex- policemen?

For the following questions answer them individually

XAT 2011 - Question 66

In a locality, there are ten houses in a row. On a particular night a thief planned to steal from three houses of the locality. In how many ways can he plan such that no two of them are next to each other?

XAT 2011 - Question 67

If $$x=(9+4\sqrt{5})^{48} = [x] +f$$, where [x] is defined as integral part of x and f is a fraction, then x (1 - f) equals

XAT 2011 - Question 68

Let $$a_{n} = 1 1 1 1 1 1 1..... 1$$, where 1 occurs n number of times. Then,

i. $$a_{741}$$ is not a prime.

ii. $$a_{534}$$ is not a prime.

iii. $$a_{123}$$ is not a prime.

iv. $$a_{77}$$ is not a prime.

Based on the following information

Total income tax payable is obtained by adding two additional surcharges on calculated income tax.

Education Cess : An additional surcharge called ‘Education Cess’ is levied at the rate of 2% on the amount of income tax.

Secondary and Higher Education Cess : An additional surcharge called ‘Secondary and Higher Education Cess` is levied at the rate of 1% on the amount of income tax.

XAT 2011 - Question 69

Sangeeta is a young working lady. Towards the end of the financial year 2009 - 10, she found her total annual income to be Rs. 3, 37, 425/ -. What % of her income is payable as income tax?

XAT 2011 - Question 70

Mr. Madan observed his tax deduction at source, done by his employer, as Rs. 3,17,910/-. What was his total income (in Rs.) if he neither has to pay any additional tax nor is eligible for any refund?

.webp)