Answer the questions based on the following information.

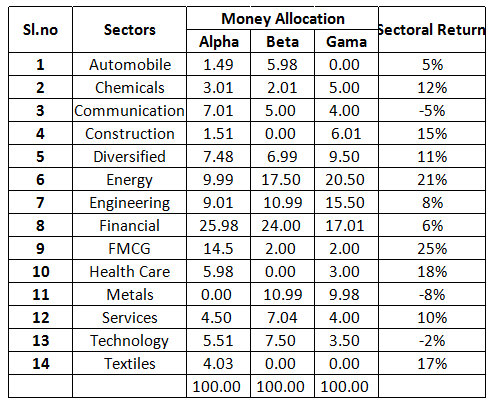

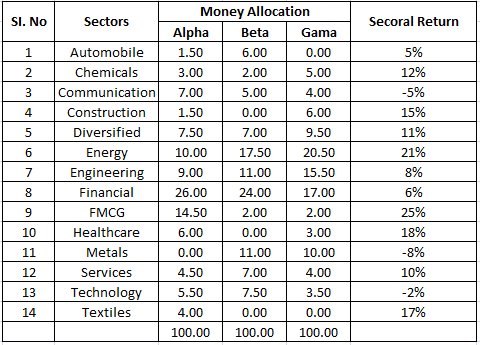

The table below gives the details of money allocation by three Mutual funds namely, Alpha, Beta, and Gama. The return for each fund depends on the money they allocate to different sectors and the returns generated by the sectors. The last column of the table gives return for each of the sectors for a one year period.

Ms. Hema invested Rs. 10.00 lakhs in fund Gama in the beginning of the period. What will be the value of the investment at the end of 1 year period?

Solution

As the numbers are far apart we can approximate the money allocation data to the nearest multiple of 0.5. The money allocation data can be approximated as below.

Total return on investing Rs. 100 in fund Gama =

5*1.12+4*.95+6*1.15+9.5*1.11+20.5*1.21+15.5*1.08

+17*1.06+2*1.25+3*1.18+10*.92+4*1.1+3.5*.98 = Rs. 109.48.

Hence, total return of an investment of 10 lakhs in fund Gama after a year = $$\dfrac{109.48}{100}*10$$ = 10.948 lakhs $$\approx$$ 10.95 lakhs.

Hence, option B is the correct answer.

Create a FREE account and get:

- All Quant Formulas and shortcuts PDF

- 170+ previous papers with solutions PDF

- Top 5000+ MBA exam Solved Questions for Free