answer questions based on the following information:

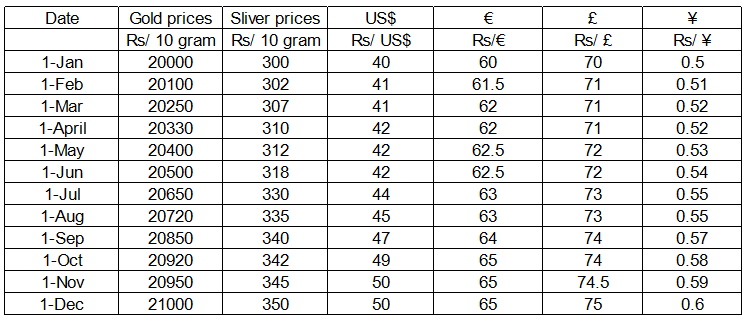

In the beginning of the year 2010, Mr. Sanyal had the option to invest Rs. 800000 in one or more of the following assets – gold, silver, US bonds, EU bonds, UK bonds and Japanese bonds. In order to invest in US bonds, one must first convert his investible fund into US Dollars at the ongoing exchange rate. Similarly, if one wants to invest in EU bonds or UK bonds or Japanese bonds one must first convert his investible fund into Euro, British Pounds and Japanese Yen respectively at the ongoing exchange rates. Transactions were allowed only in the beginning of every month. Bullion prices and exchange rates were fixed at the beginning of every

month and remained unchanged throughout the month. Refer to the table titled “Bullion Prices and Exchange Rates in 2010" for the relevant data.

Bullion Prices and Exchange Rates in 2010

Interest rates on US, EU, UK and Japanese bonds are 10%, 20%, 15% and 5% respectively.

Mr. Sanyal invested his entire fund in gold, US bonds and EU bonds in January 2010. He liquefied his assets on 31st August 2010 and gained 13% on his investments. If instead he had held his assets for an additional month he would have gained 16.25%. Which of the following options is correct?

Solution

If you go through the options, you will find that only option B supports the given conditions.

Let the ratio of investments in gold, US and EU bonds be 40%, 40% and 20%, respectively.

Thus, the investment amounts are 320000, 320000 and 160000, respectively.

For returns in August 2010:

Gold: (20720/20000) *320000 = 331520

US bonds: (45/40)*320000 + (320000 * 8 * 10)/(12 * 100) = 381333

EU bonds: (63/60)*160000 + (160000 * 8 * 20)/(12 * 100) = 189333

Thus, total returns in August = 902186

Thus, percentage return = 90218600/800000 = 13 ( approx.)

Hence, it satisfies the condition for August.

For returns in September 2010:

Gold: (20850/20000) *320000 = 333600

US bonds: (47/40)*320000 + (320000 * 9 * 10)/(12 * 100) = 400000

EU bonds: (64/60)*160000 + (160000 * 9 * 20)/(12 * 100) = 194666

Thus, total returns in August = 928266

Thus, percentage return = 92826600/800000 = 16.25 ( approx.)

Hence, it satisfies the condition for September, too.

Hence, option B is the answer.

Create a FREE account and get:

- All Quant Formulas and shortcuts PDF

- 15 XAT previous papers with solutions PDF

- XAT Trial Classes for FREE