answer questions based on the following information:

In the beginning of the year 2010, Mr. Sanyal had the option to invest Rs. 800000 in one or more of the following assets – gold, silver, US bonds, EU bonds, UK bonds and Japanese bonds. In order to invest in US bonds, one must first convert his investible fund into US Dollars at the ongoing exchange rate. Similarly, if one wants to invest in EU bonds or UK bonds or Japanese bonds one must first convert his investible fund into Euro, British Pounds and Japanese Yen respectively at the ongoing exchange rates. Transactions were allowed only in the beginning of every month. Bullion prices and exchange rates were fixed at the beginning of every

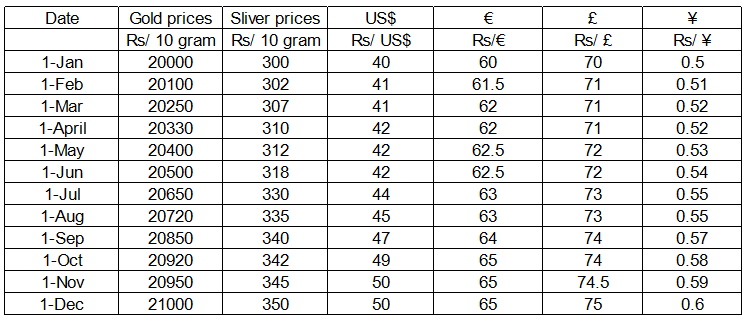

month and remained unchanged throughout the month. Refer to the table titled “Bullion Prices and Exchange Rates in 2010" for the relevant data.

Bullion Prices and Exchange Rates in 2010

Interest rates on US, EU, UK and Japanese bonds are 10%, 20%, 15% and 5% respectively.

At the beginning of every month, by sheer luck, Mr. Sanyal managed to correctly guess the asset that gave maximum return during that month and invested accordingly. If he liquefied his assets on 31st December 2010, how much was the percentage gain from his investments?