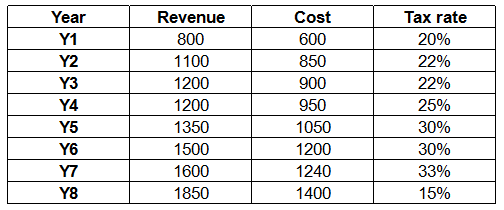

The table given below represents the cost, revenue and tax rate for XYZ Limited for a period of 8 years. Cost and revenue are given in Rs '000 crores.

Profit for any year = revenue — cost

Profit after tax for any year = profit of that year - tax of that year

tax on any year = tax rate of that year x profit of that year

Solution

Tax for year 1 (in Rs '000 crores) = $$\frac{20}{100}(800-600)=\frac{1}{5}\times200=40$$

=> Profit after tax for year 1 (in Rs '000 crores) = 200 - 40 = 160

Similarly, profit after tax (in Rs '000 crores) for year :

Year 2 : $$\frac{(100-22)}{100}(250)$$ = 195

Year 3 : $$\frac{(100-22)}{100}(300)$$ = 234

Year 4 : $$\frac{(100-25)}{100}(250)$$ = 187.5

Year 5 : $$\frac{(100-30)}{100}(300)$$ = 210

Year 6 : $$\frac{(100-30)}{100}(300)$$ = 210

Year 7 : $$\frac{(100-33)}{100}(360)$$ = 241.2

Year 8 : $$\frac{(100-15)}{100}(450)$$ = 382.5

=> Total sum = 160 + 195 + 234 + 187.5 + 210 + 210 + 241.2 + 382.5 = 1820.2

=> Ans - (C)

Create a FREE account and get:

- Free SSC Study Material - 18000 Questions

- 230+ SSC previous papers with solutions PDF

- 100+ SSC Online Tests for Free