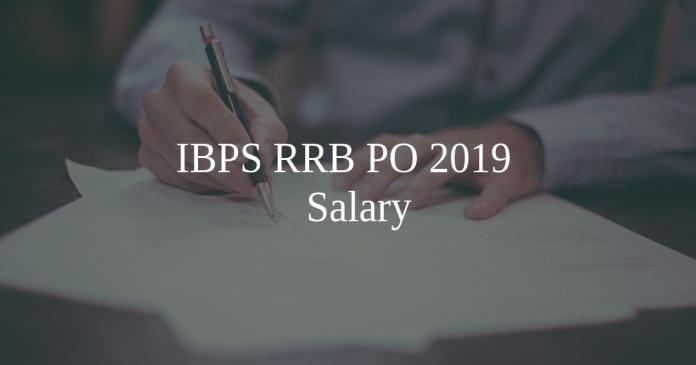

IBPS PO Salary 2019 – In-hand, Salary Structure, Perks – After 7th Pay Commission

This Year IBPS has released the Notification for the post of Probationary Officer. As per the official notification, there are total 4336 vacancies for the post of Probationary Officers in total of 17 public sector banks. Interested applicants can start filling out the application form from 07/08/2019 and the last date to fill the application Form is 28/08/2019.

As of now, a IBPS PO draws a monthly in-hand salary near Rs. 36,570 depending on the place of posting. And that should give enough impetus to prepare for the exam, as of now. A lot depends on the bank in which the candidate gets posting.

105 IBPS PO Mocks for Rs. 199. Enroll Now

As the number of vacancies is dwindling with each passing year, aspirants must leave nothing to luck. IBPS PO mock tests will prove to be helpful in finding out the areas in which you fall behind. Try IBPS PO online preparation to bridge the gaps in your preparation. Make sure you get to know the exam well by practising IBPS PO previous year papers.

IBPS PO salary After 7th Pay Commission:

Most aspirants believe that there will be an increase in the IBPS PO salary after 7th pay commission. Let us start by busting some myths. Nationalized banks neither come under the pay structure of central government nor that of State government. Only the government institutions adhere to the norms set by pay commission. Hence, there will be no increase in the IBPS PO salary after 7th pay commission.

That’s not all bad news either. The 11th bipartite settlement is under consideration. From the employee’s side, there have been requests to make the salary of IBPS POs to Rs. 61,000. The figure looks overly optimistic though. A more practical approach is to expect the pay of POs to rise by 5000 – 8000 rupees and that of clerks to increase by Rs. 2000 – Rs. 4000.

Again, the 11th bipartite settlement is still under negotiation, and it took around 3 years to implement the 10th bipartite settlement. Hence, wage revisions in the immediate future are highly unlikely.

Though the prospects of wage hikes look bleak, banks do not expect its officers to live hand to mouth.

Let us have a look at what a fresher PO gets as salary as of now:

Basic Pay & In-Hand Salary of IBPS PO:

- The basic pay-scale for IBPS RRB PO is Rs. 23700-(980×7)-30560-(1145×2)-32850-(1310×7)-42020. Dearness allowance is decided based on Consumer Price Index.

- The housing rent allowance is 9% or 8% or 7% depending on the place of posting.

- The IBPS PO in-hand salary varies from Rs. 33,000 to Rs. 38,000 depending on the location of posting.

Apart from these, the job entails various perks.

IBPS PO Quant Formulas & Shortcuts

Leased Accommodation:

Officers can opt for leased accommodation (depending on the banks). The limit can go as high as Rs. 30,000 in Mumbai to as low as Rs. 8000 in some rural areas. Banks set the limit according to the cost of living in the city (Class X, Class Y and Class Z cities).

Some banks provide official accommodation and hence, this feature may not be available.

Travelling Allowance:

The bank will reimburse any expense incurred due to travelling for official purposes. Amount worth 30 litres of petrol is also reimbursed every month (depends on the bank).

Medical Allowance:

Bank pays Rs. 8000 a year as medical allowance:

Other Allowances:

- Apart from these, there are various other perks such as newspaper reimbursement, conveyance allowance etc.

- Bank PO offers one of the finest job prospects. Officers can increase their pay by clearing certificate exams such as JAIIB and CAIIB.

- The career growth that this job offers is immense as compared to other government jobs. Banks offer promotions mainly on the basis of the performance of the officer. Also, in most other jobs, the government usually reserves the top posts for candidates who make it through UPSC or for eminent personalities from the field.

- By getting timely promotions, one can reach the general manager level quickly (Within 15 – 20 years). After that, the climb becomes tougher as the appointments are usually made directly. A point to note is that the CMD of SBI, Arundhati Bhattacharya started her career as a probationary officer.

- Moreover, banks are one of the few organisations where promotions depend not purely on seniority. Performance plays a vital role too. Hence, aspirants must start preparing for the exam without any further delay.

IBPS PO 2019 Salary In Detail :

| Basic Pay | 23,700 |

| DA | 10163.63 |

| CCA | 870 |

| Special Allowances | 1836.75 |

| Transport Allowances | — |

| Total(With out HRA) | 36,570.38 |

| HRA | 2133.00 |

| Gross With HRA | 38,703.38 |

| Entertainment | 500 |

| Medical Aid | 8000 |

| Petrol | 3000 |

| News Paper Bill | 300 |

| Canteen Subsidy | 400 |

| Telephone | 400 |

| Pension Contribution | 2500 |

| Gross Annual CTC (With HRA and with out leased accommodation ) | 5,57,640.52 |

![SBI PO Puzzles Questions PDF [Most Important] _ Puzzles Questions](https://cracku.in/blog/wp-content/uploads/2022/10/Puzzles-Questions--218x150.png)